Sample of certificate of liability insurance – it’s not just a piece of paper; it’s your shield against unforeseen risks. Imagine a world where your business is exposed, vulnerable to lawsuits and financial ruin. This document acts as your fortress, outlining the specific protection your insurance policy offers. Understanding this document is crucial for any business, from a solopreneur to a multinational corporation.

This guide dives deep into the world of liability insurance certificates, exploring their crucial elements, variations, and practical applications. We’ll dissect the essential components, from policy limits to expiration dates, providing clear insights for anyone needing to understand and utilize these certificates effectively.

Understanding Certificate of Liability Insurance

A certificate of liability insurance is a crucial document for businesses and individuals involved in contracts or projects requiring proof of insurance coverage. It acts as a concise summary of the insurance policy, providing assurance to parties that the insured entity has the necessary liability protection. This document simplifies the process of verifying coverage, saving time and reducing potential risks.The purpose of a certificate of liability insurance is to demonstrate to potential clients, partners, or other stakeholders that a company or individual possesses insurance coverage for potential liabilities arising from their operations.

Right, like, a sample certificate of liability insurance is totally crucial, you know? Basically, it’s proof that you’re covered if somethin’ goes wrong, which is pretty important, especially if you’re runnin’ a business like, say, sammy’s woodfired pizza lax. Gotta make sure you’ve got the right insuranc’ in place, you feel? So yeah, a sample certificate is key for peace of mind.

This assurance helps mitigate risks for all parties involved in a transaction. It confirms the policyholder’s commitment to financial responsibility and minimizes disputes.

Key Components of a Certificate

Certificates of liability insurance typically contain specific details to ensure accuracy and clarity. These components are vital for understanding the extent and nature of the coverage. The details allow for a proper assessment of the insurance protection.

Common Sections in a Certificate of Liability Insurance

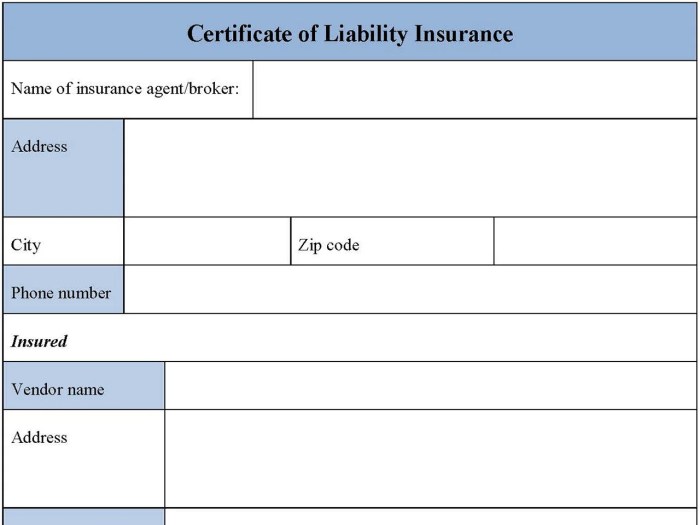

A well-structured certificate of liability insurance typically includes several essential sections, each providing specific information. This table Artikels common sections and their descriptions.

| Section | Description |

|---|---|

| Policyholder Information | Identifies the insured entity, including name, address, and policy number. This establishes the identity of the party covered by the insurance. |

| Insurance Company Information | Provides details about the insurance company issuing the policy, including name, address, and contact information. This verifies the legitimacy and reliability of the insurance provider. |

| Policy Effective Dates | Specifies the dates when the policy begins and ends, outlining the duration of coverage. Understanding the policy’s validity is crucial for evaluating the risk associated with the policy. |

| Policy Limits | Indicates the maximum amount the insurance company will pay in the event of a claim. This clarifies the financial responsibility and potential compensation for liabilities. |

| Description of Operations/Activities | Details the types of activities or operations covered by the policy. This allows for proper risk assessment and confirms the scope of the insurance coverage. |

| Type of Insurance | Clearly identifies the type of liability insurance (e.g., general liability, professional liability, auto liability) and the specific coverage. This ensures clarity on the type of risk being insured against. |

| Additional Insured Information | Specifies any additional parties covered by the policy. This is important in cases where multiple parties are involved in a project. |

| Certificate Issuance Date | Indicates the date when the certificate was issued. This date is essential for determining the validity and currency of the certificate. |

| Name of Certificate Holder | Identifies the party receiving the certificate, usually a client or customer. This specifies who the certificate is being provided to. |

Types and Variations

Liability insurance certificates aren’t all created equal. Understanding the different types and their variations is crucial for businesses and individuals alike. Different types of liability coverages cater to specific needs, impacting the content and specifics of the certificate.Knowing these nuances helps ensure you’re receiving the appropriate coverage and avoiding potential gaps in protection. This section will delve into the specifics of various liability insurance certificates, from general liability to commercial policies, highlighting the key distinctions in their content.

General Liability Insurance Certificates

General liability insurance protects businesses from claims arising from accidents or injuries on their premises or caused by their products or services. These certificates typically include details like the policyholder’s name, policy number, effective and expiration dates, and the amount of liability coverage. They also specify the types of operations covered, often including premises operations, products-completed operations, and advertising injury.

A crucial aspect of general liability certificates is the description of the insured’s activities and the territories covered. This ensures clarity regarding the scope of protection.

Professional Liability Insurance Certificates

Professional liability insurance, also known as errors and omissions (E&O) insurance, safeguards professionals against claims of negligence or errors in their work. These certificates differ from general liability by focusing on the professional services provided. They may include specifics like the insured’s professional title or field, the types of services offered, and any specific exclusions or limitations related to the insured’s professional obligations.

A crucial distinction is the potential for coverage gaps if the professional services are not clearly defined within the certificate.

Commercial Liability Insurance Certificates

Commercial liability insurance certificates are designed for businesses, encompassing various aspects of their operations. These certificates typically detail the specific risks associated with the business, such as property damage, bodily injury, and advertising injury. The content often includes details about the insured’s business operations, locations, and products/services. They often contain endorsements or addenda that specify additional coverage or limitations.

Commercial certificates might contain intricate details about the specific industries or business practices.

Comparison of Personal and Commercial Liability Insurance Certificates

| Type | Key Differences |

|---|---|

| Personal | Typically covers homeowner or renter’s liability, often with lower coverage limits. Focuses on personal activities and property. Content is generally straightforward and concise. |

| Commercial | Covers business operations, with higher coverage limits and more comprehensive descriptions of insured activities, locations, and potential liabilities. More complex content and potential endorsements. |

Essential Elements and Clauses

Decoding a certificate of liability insurance isn’t rocket science, but knowing the crucial elements is key to understanding your coverage. This section delves into the essential components, highlighting clauses like policy limits, effective dates, and expiration dates, all vital for a clear picture of your insurance protection. Understanding endorsements and exclusions also helps in tailoring the coverage to your specific needs.A well-crafted certificate of liability insurance is a roadmap to your protection.

It spells out the specific terms and conditions under which you’re insured, from the amount of coverage you have to the circumstances it applies to. Knowing these elements is critical for businesses and individuals alike.

Policy Limits

Policy limits define the maximum amount the insurer will pay out in the event of a claim. Understanding this limit is crucial to ensuring adequate protection. For example, a business with substantial potential liability needs a higher policy limit compared to a small business with limited exposure. This crucial element safeguards you from exceeding your coverage in a claim.

A realistic assessment of potential risks is essential in determining the appropriate policy limit.

Effective and Expiration Dates

Effective and expiration dates mark the start and end of coverage. These dates are crucial for understanding when the policy is in force. Failure to renew or have a clear understanding of the coverage duration could lead to gaps in protection. A missed renewal can expose you to substantial risk. Accurate records and prompt renewal are vital.

Endorsements

Endorsements are modifications to the standard policy terms. They are important because they can add or remove specific coverages, altering the original scope of the policy. For instance, a professional liability policy may need an endorsement to cover specific services or industries. Endorsements are tailored to specific situations.

Exclusions and Limitations

Exclusions and limitations are conditions where the policy doesn’t apply. These are often overlooked but crucial for understanding the policy’s boundaries. For instance, a general liability policy might exclude coverage for intentional acts. Knowing these limitations is essential to avoid surprises when a claim arises. Common exclusions include intentional acts, work performed by others, and certain types of property damage.

Crucial Clauses Summary

| Clause | Explanation | Importance |

|---|---|---|

| Policy Limits | Maximum amount insurer will pay per claim or aggregate. | Determines the financial protection available. |

| Effective Dates | Start date of coverage. | Indicates when protection begins. |

| Expiration Dates | End date of coverage. | Indicates when protection ends. |

| Endorsements | Modifications to standard policy terms. | Tailors coverage to specific needs. |

| Exclusions | Specific circumstances where coverage does not apply. | Identifies limitations and potential gaps in coverage. |

Issuance and Validation

A certificate of liability insurance isn’t just a piece of paper; it’s a crucial document that proves your business is covered. Understanding how these certificates are issued and validated is vital for anyone needing to confirm coverage. This section delves into the process, ensuring you can confidently verify the authenticity and validity of any certificate presented.The issuance and validation of a certificate of liability insurance involves a defined process between the insurance company and the insured.

This process is designed to protect both parties and ensure accurate representation of coverage. Accurate validation is essential to avoid costly misunderstandings or legal disputes.

Obtaining a Certificate

The insured initiates the process by requesting a certificate of insurance from their insurance provider. This request typically involves specifying the policy details, coverage limits, and the intended recipient. The insurance company then issues a certificate reflecting these specifics, acting as a summary of the policy. The insured must review the certificate for accuracy before it is distributed.

Yo, like, need a sample of a liability insurance cert? It’s all good, but if you’re after some grub, you gotta check out this Kansas food stamp application PDF kansas food stamp application pdf first. Sorted. Then, you can get your insurance sorted too. Basically, you need both, right?

Sorted, mate.

Verifying Authenticity

The certificate’s authenticity and validity must be confirmed before relying on it. This crucial step ensures the certificate reflects the actual policy and coverage. The insured and the recipient have a shared responsibility in ensuring the certificate’s integrity.

Insurance Company’s Role

The insurance company plays a vital role in the issuance process. They are responsible for accurately documenting the policy details, verifying the insured’s information, and ensuring the certificate aligns with the agreed-upon coverage. The company’s reputation is linked to the accuracy of the issued certificates.

Insured’s Role

The insured is responsible for ensuring the accuracy of the information provided to the insurance company. They must review the certificate for any discrepancies before its distribution. This step is crucial to avoid potential issues with coverage.

Methods for Validation

Various methods exist for validating certificates, each with its own pros and cons. Careful consideration of these options is crucial for the recipient.

| Method | Description |

|---|---|

| Direct Contact | The recipient can directly contact the insurance company to verify the certificate’s details. This involves providing the policy number and other identifying information. |

| Insurance Information Service (IIS) | An IIS, a third-party service, can be utilized to validate certificates. This is a quick and efficient method, especially for large-scale verification needs. |

| Policy Documentation | Reviewing the underlying insurance policy is the definitive method for verification. This approach provides a comprehensive view of the coverage details, ensuring accuracy. |

| Online Portals | Some insurance companies provide online portals or platforms for verifying certificates. These portals allow users to access policy information directly. |

Common Uses and Applications

A certificate of liability insurance isn’t just a fancy document; it’s a vital piece of the puzzle for businesses and individuals alike. It acts as a guarantee that the insured party is protected against potential financial losses arising from liability claims. Understanding its applications across various sectors is crucial for navigating the complexities of legal and financial obligations.Certificates of liability insurance are required in a wide array of situations to protect both the insured and those who might be affected by their actions.

They demonstrate a company’s commitment to risk management and financial responsibility, which is a key factor in building trust and confidence in their dealings with others.

Situations Requiring Liability Insurance Certificates

Liability insurance certificates are often demanded in situations where potential harm or damages could arise. This is especially true in industries where there’s a higher likelihood of accidents or property damage. The certificate provides tangible evidence of insurance coverage, allowing those dealing with the insured to feel confident that they are protected against financial repercussions.

Industries and Professions Needing Certificates

Many industries and professions require or benefit from demonstrating liability insurance coverage. Construction, transportation, and healthcare are prime examples. The risk of accidents and damages is significantly higher in these sectors, making liability insurance crucial for both legal and practical reasons.

- Construction Industry: Construction projects, regardless of scale, often demand liability insurance certificates to safeguard against potential injuries or property damage. This is a crucial aspect of contractual agreements and often a prerequisite for securing permits and working with clients.

- Transportation Companies: Trucking, delivery, and passenger transportation businesses frequently need to show liability insurance certificates to protect against accidents or damages involving vehicles and their cargo or passengers. These certificates are a prerequisite for operating in many areas.

- Healthcare Providers: Medical professionals and facilities need liability insurance certificates to safeguard themselves against potential malpractice claims or injuries sustained in the course of providing medical services. The certificate is crucial in building trust and confidence with patients.

Impact on Contractual Agreements

Liability insurance certificates play a significant role in contractual agreements. They act as a critical element in ensuring the protection of all parties involved. Many contracts explicitly require a certificate of insurance as a condition for commencing work or entering into a transaction. This provision is a vital risk management strategy for both the party seeking insurance and the party who is being protected from financial liability.

Liability Insurance in Construction Projects

Construction projects are a prime example of how liability insurance certificates are used. Contractors and subcontractors are frequently required to provide certificates of insurance to demonstrate their coverage for potential liabilities arising from accidents or damages on the job site. These certificates are essential for ensuring the protection of the project owners, architects, and other stakeholders.

- General Contractors: Frequently required to prove they have sufficient liability insurance coverage to protect themselves and the project from financial loss due to accidents, property damage, or lawsuits.

- Subcontractors: Similar to general contractors, subcontractors must provide evidence of liability insurance coverage to protect their own interests and those of the project as a whole.

- Project Owners: By requiring liability insurance certificates, project owners ensure the financial security of their investment and protect themselves against potential losses related to accidents or damages.

Examples of Businesses Requiring Certificates

Numerous businesses require liability insurance certificates as part of their operational or contractual requirements. Examples include those working with high-value equipment, those providing services that could potentially cause harm, and those handling sensitive data or materials.

- Event Planners: Event planners, especially those handling large-scale events, often need to provide liability insurance certificates to protect themselves and the venue from potential liabilities associated with the event.

- Manufacturers: Manufacturing businesses often need liability insurance certificates to cover potential risks associated with their production processes and equipment.

- Retailers: Retail businesses that offer services such as installation, maintenance, or repairs may be required to have liability insurance certificates to cover potential liabilities.

Illustrative Examples: Sample Of Certificate Of Liability Insurance

A certificate of liability insurance acts as a crucial document verifying an insured’s coverage. Understanding its structure and details is essential for both buyers and sellers. This section provides practical examples to illuminate the practical application of these certificates.

Sample Certificate of Liability Insurance

This example demonstrates a simplified certificate format, highlighting key elements. Note that actual certificates are more complex and may include additional clauses.

| Section | Description |

|---|---|

| Certificate Holder | Acme Corporation |

| Policy Number | 2023-12345 |

| Effective Date | October 26, 2023 |

| Expiration Date | October 26, 2024 |

| Policy Issuer | Reliable Insurance Company |

| Coverage Type | Commercial General Liability |

| Limits of Liability | $1,000,000 per occurrence, $2,000,000 in the aggregate |

| Additional Insured(s) | None listed |

| Description of Operations | General contracting services |

| Location of Operations | 123 Main Street, Anytown, USA |

Interpreting Certificate Details, Sample of certificate of liability insurance

The certificate above shows the essential elements for liability insurance. The “Policy Number” identifies the specific insurance policy. “Effective Date” and “Expiration Date” define the period of coverage. “Limits of Liability” specify the maximum amount the insurer will pay for a claim.

Detailed Description of a Sample Certificate’s Layout

A comprehensive certificate typically features sections for the insured, policy details, coverage specifics, and additional insured information. The sections are usually organized logically, presenting the necessary data for clear understanding. A well-structured certificate aids in verification of coverage and minimizes ambiguity. For example, a certificate will clearly indicate the type of liability insurance, such as general liability or professional liability, and the specific limits of liability.

Use Cases for Sample Certificate

A sample certificate is used for several purposes. It verifies the existence and scope of insurance coverage. It’s crucial in situations like bidding on contracts, where potential clients need proof of financial protection. Furthermore, it provides evidence of liability insurance to ensure compliance with contractual obligations. This verification is crucial in business-to-business transactions, where legal and financial safeguards are paramount.

Closure

In conclusion, a sample of certificate of liability insurance is more than just a document; it’s a vital tool for protecting your business and ensuring its smooth operation. Navigating the complexities of different types, clauses, and validation methods can feel overwhelming, but this comprehensive guide provides a clear path to understanding and using this essential document effectively. Armed with this knowledge, you can confidently protect your business from potential liabilities.

General Inquiries

What are the common sections found in a liability insurance certificate?

Typical sections include the insured’s information, policy details, coverage limits, effective and expiration dates, and the insurer’s information. A well-organized table will clarify these.

How do I verify the authenticity of a liability insurance certificate?

Authenticity can be verified by contacting the insurance company directly or using the verification methods Artikeld in the certificate itself. Always check the details carefully, looking for inconsistencies.

What is the difference between personal and commercial liability insurance certificates?

Personal certificates typically cover individual needs, while commercial certificates cater to the unique requirements of businesses. The coverage and limits differ significantly, depending on the business type and operations.

What are some examples of industries needing liability insurance certificates?

Construction, healthcare, professional services, and manufacturing are a few examples of industries where liability insurance certificates are crucial. They protect against potential damages or claims related to their work.