Can you have renters insurance on two places? This multifaceted query delves into the complexities of securing adequate protection for personal belongings and liabilities across multiple residences. Navigating the nuances of coverage, costs, and potential limitations demands a meticulous examination of policy provisions and financial implications.

From the practical considerations of a student juggling a dorm and an apartment, to the professional navigating two apartments, this exploration will unpack the intricate web of options and stipulations. The potential benefits and pitfalls of a single policy covering multiple locations will be thoroughly examined, ensuring clarity in a subject often shrouded in ambiguity.

Understanding Dual Coverage

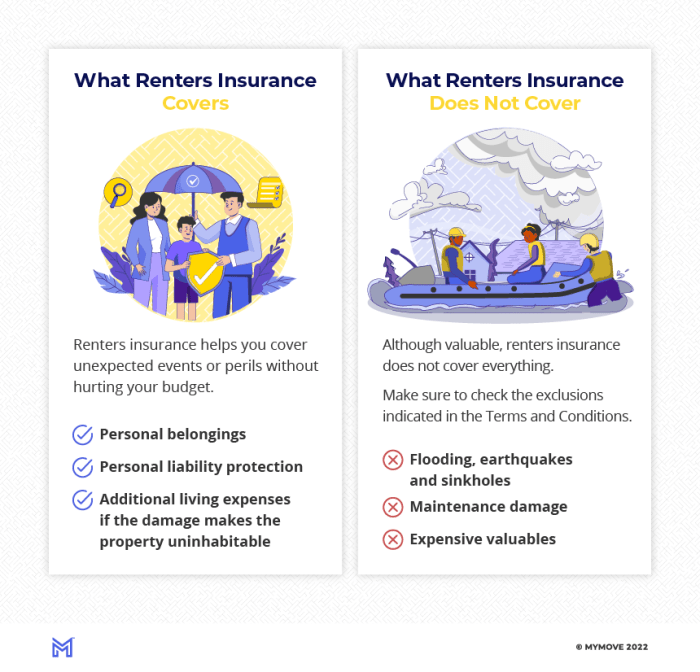

Embarking on a journey of dual residency often presents unique insurance challenges. Comprehending renters insurance, particularly when applied to multiple locations, is paramount. This knowledge empowers informed decisions, safeguarding your possessions and peace of mind. The following discussion delves into the intricacies of renters insurance, focusing on the benefits and considerations of coverage across multiple dwellings.Renters insurance is a crucial financial safeguard for individuals renting properties.

It protects personal belongings from unforeseen events such as fire, theft, and water damage. This protection extends to liability coverage, shielding you from potential financial repercussions if someone is injured on your property. Essentially, it’s a safety net in the event of unexpected disruptions.

Renters Insurance Fundamentals

Renters insurance provides comprehensive coverage for your personal property and liability. It typically covers various risks, including fire, theft, vandalism, and water damage. This coverage is tailored to protect items like furniture, electronics, clothing, and other personal belongings. The coverage amount is typically determined by the value of the insured items.

Types of Renters Insurance Coverage

Different types of renters insurance policies cater to diverse needs and preferences. Standard policies offer basic protection, while enhanced options provide more extensive coverage for specific risks or situations. Understanding the nuances between these options is essential for selecting the most suitable plan. For instance, some policies may include coverage for lost or damaged belongings while traveling.

Comparing Coverage Options

A comparative analysis of different renters insurance options reveals varying levels of protection. Policies may differ in the amount of coverage for specific items, the liability limits, and the inclusion of additional benefits like medical payments coverage. Understanding the details of each option is vital for making an informed choice. For example, one policy might offer higher coverage for jewelry, while another might include extra coverage for certain types of accidents.

Generally, yes, you can have renters insurance covering two properties. However, it’s important to check with your insurance provider, as the specific rules vary. For instance, if you’re renting a hotel intown luxury house in Rome, like hotel intown luxury house rome , you’d need to ensure your policy covers both locations. Ultimately, confirming coverage for multiple residences is crucial for adequate protection.

Benefits of Renters Insurance in a Single Location

Having renters insurance in a single location provides a protective shield against financial losses stemming from unforeseen circumstances. It offers peace of mind knowing that personal belongings and liability are covered. For instance, a fire incident in a rented apartment would be mitigated by the policy. This protection is essential for securing your assets and maintaining financial stability during challenging times.

Insurance Policies for Multiple Locations

Embarking on a journey of multiple residences demands a robust understanding of your insurance options. Navigating the complexities of renter’s insurance across various locations requires careful planning and a keen eye for detail. A single policy can often streamline the process, but understanding the nuances of multiple-location coverage is essential. This knowledge empowers you to make informed decisions, safeguarding your belongings and peace of mind wherever you reside.Insurance policies for multiple locations are designed to offer protection for your belongings and possessions across various residences.

Careful planning and understanding the nuances of your policy can simplify the process. The key lies in comprehending how insurance companies handle the complexities of multiple residences and the potential implications of such coverage.

Scenarios Requiring Multiple Location Coverage

Students moving between on-campus and off-campus housing, or individuals with multiple apartments or homes for various reasons (e.g., seasonal use, temporary stays, or property maintenance) often need multiple-location coverage. Individuals frequently relocating or those with properties in different geographical areas also require this type of coverage. It is essential to identify these circumstances and choose an appropriate insurance policy.

Options for Renters Insurance on Multiple Locations

Several options exist for securing renters insurance across multiple locations. A single policy, often the most convenient choice, may encompass all your residences. Alternatively, separate policies for each location are possible, though this can lead to greater administrative complexity. The best option depends on your individual needs and the specifics of your circumstances.

How Insurance Companies Handle Multiple Locations

Insurance companies employ various approaches to manage multiple-location coverage. Some policies allow you to declare multiple locations within a single policy document, encompassing all of your possessions in one comprehensive contract. This simplifies administration and billing. Other companies may require separate policies for each location. Understanding the insurer’s approach to managing multiple locations is crucial in determining the most appropriate coverage for your needs.

Implications of Insurance on Multiple Properties

The implications of having insurance on multiple properties encompass a variety of factors. A comprehensive policy can safeguard your belongings against unforeseen events, ensuring you’re covered for any damages or losses across your residences. However, understanding the coverage limits and exclusions within your policy is vital to avoid gaps in protection. For example, if you have identical items in both locations, a policy might handle overlapping or similar items differently.

Knowing how your insurer manages such scenarios is critical.

Handling Overlapping Items Across Locations

When dealing with similar items across multiple locations, a well-structured policy can address potential overlaps. Coverage limits, deductibles, and claims processes are often designed to manage situations where possessions are replicated in different residences. This approach ensures fairness and appropriate compensation in case of damage or loss. Careful policy review and understanding of your insurer’s procedures for handling overlapping items across locations are paramount to avoid disputes and ensure adequate protection.

Policy Design Considerations for Dual Coverage

Securing renters insurance for multiple locations requires a strategic approach beyond simply purchasing two separate policies. This involves careful consideration of the specific coverage needs for each location and the potential for gaps in protection. Understanding how policies adapt to dual coverage scenarios is crucial for comprehensive protection.Effective dual coverage isn’t just about buying more insurance; it’s about optimizing your existing coverage to meet your unique needs.

By understanding the potential pitfalls and proactively planning for them, you can confidently protect your belongings and peace of mind across multiple residences.

Coverage Adaptability for Multiple Locations

Careful consideration must be given to how renters insurance policies adjust to protect belongings across multiple locations. Coverage items vary in value and importance, and must be reviewed in the context of each location. A standardized approach may not be suitable for all situations.

| Item | Location 1 Coverage | Location 2 Coverage | Potential Coverage Gaps |

|---|---|---|---|

| Furniture | Full replacement cost for standard furniture | Partial or limited coverage for furniture, possibly based on replacement cost values | If a major piece of furniture in Location 2 is not covered at full replacement cost, there may be a coverage gap. |

| Electronics | Full coverage for electronics | Coverage for essential electronics, but may not cover all items | If a significant number of electronics are only partially covered or not at all, this represents a gap in coverage. |

| Clothing and Personal Effects | Full coverage for clothing and personal effects | Partial coverage for clothing and personal effects | There might be insufficient coverage for clothing and personal effects in Location 2, potentially leading to gaps in coverage. |

| Valuables | Full coverage for jewelry and other valuables | Coverage limited to specified items, or a percentage of the total value | If the value of valuables in Location 2 exceeds the policy limit, there might be an insufficient amount of coverage. |

| Personal Liability | Covers liability for incidents at Location 1 | Covers liability for incidents at Location 2 | Coverage gaps are unlikely as personal liability generally extends to both locations. |

Potential Issues in Dual Coverage

Implementing dual coverage can present several challenges. Understanding these potential problems is key to navigating the process effectively.

- Coverage Limits: Policies often have maximum payout limits. If the total value of belongings in both locations exceeds the policy limit, a significant portion of possessions may not be covered.

- Deductibles: Separate deductibles for each location could lead to substantial out-of-pocket expenses if claims arise in both locations. Consider the impact of potentially higher deductibles in the overall financial plan.

- Policy Exclusions: Policies may exclude certain items or events, even if they are covered in one location. These exclusions can be location-specific and may affect coverage in either location.

- Communication Breakdown: Misunderstandings with the insurance provider about the coverage scope for each location can result in inadequate protection. Clear communication is vital.

- Policy Variations: Insurance companies have different policy structures. The exact coverage details for each location under a single policy may vary, and it’s essential to understand the specifics of the company you choose.

Ensuring Adequate Coverage Across Locations

Protecting belongings in multiple locations demands a strategic approach. Effective strategies include detailed inventory creation and proactive communication.

- Comprehensive Inventory: Create a detailed inventory of belongings in each location, including descriptions, values, and purchase dates. This inventory acts as a critical reference in case of a claim.

- Specific Policy Review: Thoroughly review the policy details for both locations. Understand the specific coverage limits and exclusions for each item and situation.

- Additional Insurance Options: Explore supplemental insurance options for valuable items or specialized needs.

- High-Value Item Protection: Invest in specialized coverage for high-value items like jewelry or collectibles, ensuring they are adequately protected.

- Professional Photography: Take detailed photographs and videos of belongings in each location, documenting their condition. These records provide evidence for insurance claims.

Clear Communication with Insurance Providers

Open communication with the insurance provider is essential for navigating dual coverage effectively.

- Precise Details: Provide the insurance company with precise details about the locations covered and the possessions within each.

- Policy Clarification: Ask questions to ensure you understand the coverage limitations and specific exclusions for each location.

- Documentation Procedures: Understand the insurance provider’s claim procedures and documentation requirements to avoid delays.

- Regular Policy Review: Regularly review your policy to ensure it aligns with your evolving needs as your belongings and locations may change.

Financial Implications and Considerations: Can You Have Renters Insurance On Two Places

Unlocking the financial wisdom behind dual renters insurance policies is crucial for informed decision-making. Understanding the cost implications, comparing options, and anticipating potential adjustments is paramount to avoiding financial surprises. This section delves into the specific financial considerations of insuring multiple locations.The financial landscape of dual renters insurance policies involves careful examination of costs, potential premium increases, and effective cost management strategies.

Analyzing these aspects will empower you to make the most financially sound choice.

Typical Costs of Renters Insurance for Multiple Locations

Renters insurance costs are influenced by factors like the value of your belongings, the location’s risk profile, and the chosen coverage levels. In situations involving multiple locations, the costs can vary significantly. Factors such as the specific coverage amounts, the deductibles, and any additional add-ons all affect the total premium. Insurance providers often evaluate each location individually when determining coverage and premiums.

Comparison of Costs: Separate Policies vs. Single Policy

The decision to secure separate policies for each location or a single policy for both involves careful evaluation of the cost implications. A single policy for both locations can sometimes be more cost-effective, especially if the coverage amounts and deductibles are appropriate for both places. However, the individual risk profiles of each location can lead to higher premiums than if you had separate policies.

- Separate Policies: This approach offers more flexibility to tailor coverage to the specific needs of each location. However, this often translates to higher overall premiums compared to a single policy.

- Single Policy: This method might provide a more consolidated approach and potentially a lower overall premium if the combined risks are considered favorable by the insurer. However, this option may not offer the same level of customization as separate policies.

Potential for Increased Premiums or Additional Fees

Insurers might assess the risk of insuring multiple locations differently, potentially resulting in increased premiums or additional fees. Factors like the location’s proximity and the potential for shared risks will play a significant role in how the insurer determines your premium. In some cases, a single policy might increase your premiums to reflect the added risk.

Calculating Total Cost of Insurance for Both Locations

Calculating the total cost involves determining the premium for each location with a separate policy or the premium for the single policy for both locations. Consider using a comparison tool provided by insurance companies or a financial advisor. To achieve accurate calculations, consider the following steps:

- Obtain individual quotes for each location with separate policies. This will provide a baseline for comparison.

- Obtain a quote for a single policy covering both locations. This will give you a direct comparison of costs.

- Compare the total cost of separate policies to the cost of the single policy.

Deductible Application Across Two Locations

Deductibles, which are the amounts you pay out-of-pocket before the insurance company begins to cover damages, might be applied differently for two locations under a single policy. For example, the total deductible amount might be split between the two locations or applied individually to each incident. Always review your policy’s specific provisions to understand how deductibles are applied to claims.

Legal and Regulatory Aspects

Navigating the legal landscape surrounding renters insurance for multiple locations demands careful consideration. Understanding the specific requirements and implications of dual coverage is crucial to ensuring your protection and avoiding potential pitfalls. A thorough grasp of these legal aspects will empower you to make informed decisions regarding your insurance policies and safeguard your belongings.The legal framework governing renters insurance varies by jurisdiction.

Each region has its own set of regulations and requirements. A nuanced understanding of these differences is essential when evaluating dual coverage options. Failing to adhere to local regulations can lead to legal complications and diminished protection.

Legal Requirements for Renters Insurance

Different jurisdictions have varying requirements for renters insurance. Some states mandate minimum coverage levels for liability, while others may not have explicit requirements for renters insurance. Researching your specific local regulations is paramount. Consult your state’s insurance department website or contact a licensed insurance agent to obtain the most accurate information. Understanding the legal mandates will help you determine whether your chosen coverage meets the necessary standards.

Legal Implications of a Single Policy Covering Two Places

A single renters insurance policy covering multiple locations might not adequately protect all belongings across different residences. Coverage limitations and exclusions could lead to gaps in protection, particularly if the policy has restrictions on the total value insured or specific exclusions for certain types of property. Insurance companies carefully define the scope of coverage for each location. Carefully scrutinize policy details to ensure that your belongings in each location are properly accounted for and protected.

Common Clauses in a Renters Insurance Policy Regarding Dual Coverage

Renters insurance policies often contain clauses addressing dual coverage. These clauses may Artikel how the coverage extends to multiple residences, how coverage amounts are allocated, and what happens if there are discrepancies in the value of items in each location. Understanding these clauses is vital to ensure proper protection for your possessions. Read the policy carefully and contact your insurance provider to clarify any uncertainties about the scope of coverage.

Responsibilities of the Renter and Insurance Company

The renter is responsible for accurately reporting all belongings and locations covered by the policy. Providing complete and accurate information about the property is paramount to ensuring the insurance policy covers all assets in both locations. The insurance company has the responsibility to provide comprehensive coverage as Artikeld in the policy. Regularly reviewing the policy and its terms and conditions is essential for both parties.

Examples of Insufficient or Inadequate Coverage

One example involves a renter with a single policy covering two apartments. If one apartment experiences a fire, the coverage might not adequately compensate for the total loss of belongings. The policy might have limitations on the total amount insured, or exclusions for certain types of damage. In another scenario, a renter moves frequently, and their policy fails to account for the transfer of possessions across locations.

These examples highlight the need for careful planning and regular review of the policy terms and conditions.

Illustrative Examples and Case Studies

Unlocking the complexities of renters insurance across multiple locations requires concrete examples. Understanding how these policies apply in diverse situations is crucial for making informed decisions. This section presents practical scenarios to illustrate the application and nuances of dual coverage, offering valuable insights into the challenges and solutions involved.

Student Living in a Dorm and an Apartment

A student, Sarah, resides in both a dorm and an apartment. Her dorm room contains essential electronics (laptop, phone, tablet), a few textbooks, and personal clothing. The apartment holds a bed, a sofa, a refrigerator, kitchenware, and more clothing. Renters insurance for the dorm would cover the electronics and personal belongings. Insurance for the apartment would cover the furniture, appliances, and other personal belongings stored there.

If a fire damages the dorm room, the insurance policy covering that location would address the loss. If the apartment is burglarized, the corresponding insurance policy would cover the stolen or damaged items. These policies act independently, safeguarding belongings in each location.

Professional Moving Between Apartments

Consider a professional, David, relocating between two apartments. He possesses valuable tools and equipment for his work, along with personal items. Insurance coverage for the first apartment would protect these possessions until the move. Insurance coverage for the second apartment would safeguard these items after the move. A key aspect is ensuring the coverage transition is seamless to prevent gaps in protection during the move.

Regarding renters insurance on multiple properties, it’s definitely possible, but the specifics vary. You might find some policies that allow it, though the details depend on the insurance provider and how much coverage you need. For example, if you’re looking for a perfume that captures the vibe of “Thank You Next,” you might consider checking out Ariana Grande’s perfume line, particularly the “Thank You Next” fragrance.

Ariana Grande perfume thank you next. Ultimately, it’s best to contact your insurer directly to get precise details about covering multiple residences with one policy.

David should review his policy wording regarding temporary storage of belongings and coverage during transit.

Renter Sharing an Apartment with a Roommate

Imagine a renter, Emily, sharing an apartment with a roommate. Both possess personal belongings. The renters insurance policy would cover Emily’s belongings and her individual liability. Any shared property, like a couch or TV, might require a separate agreement between the roommates to ensure clear responsibility and coverage in case of damage or loss. Crucially, the policy will clearly define who is responsible for what.

Complications of Shared Belongings and Liability, Can you have renters insurance on two places

Shared belongings can lead to complexities. For example, if a shared appliance breaks, determining the responsibility for repair or replacement might require collaboration between renters and a thorough review of the insurance policy. Liability for damage to shared property needs clear definition within the policy to avoid disputes. The policy should be reviewed to understand how the policy addresses shared property damage or loss.

Each renter’s responsibility must be clearly defined to avoid conflicts.

Policy Handling of Different Types of Personal Property

Renters insurance policies commonly cover a wide array of personal property, including furniture, electronics, clothing, and even valuable items like jewelry. The coverage amount for each category can vary, and the policy should be reviewed to understand the exact limits and types of personal property protected. The policy should explicitly state the extent of coverage for each category to ensure full protection.

The policy may require specific documentation, like appraisals, for certain high-value items.

Final Thoughts

In conclusion, the prospect of securing renters insurance for two or more locations necessitates a comprehensive understanding of policy stipulations, financial implications, and potential coverage gaps. While a single policy might appear attractive, the complexities surrounding overlapping items, varying costs, and the specific clauses within each policy demand careful scrutiny. This analysis underscores the importance of meticulous planning and transparent communication with insurance providers to ensure comprehensive protection for personal belongings and liabilities across multiple residences.

User Queries

Can I combine coverage for both my personal belongings and liability across multiple locations under a single policy?

Often, yes, but the specifics depend heavily on the insurance company and the policy terms. It’s essential to carefully review the policy document to understand what’s covered and the limitations.

How do deductibles work when I have insurance on multiple properties?

Deductibles are typically applied independently to each location. If an incident occurs at one property, the deductible will be assessed solely against that location, not the total policy limit.

What if I have similar items in both locations, will coverage overlap?

Insurance companies often handle overlapping items by applying the policy’s maximum coverage for those items. However, the policy wording should be thoroughly checked to understand how these items are assessed in terms of maximum payout.

Are there any legal implications of using a single policy for two properties?

While no law explicitly prohibits it, there are potential implications based on individual state laws or the terms and conditions of the policy.