How to cancel Bristol West insurance policies is a process governed by specific procedures. Understanding these procedures is crucial for a smooth cancellation process. This document Artikels the steps involved, from comprehending cancellation policies to handling post-cancellation issues, including important considerations before initiating the cancellation process. Detailed information is provided for various policy types, methods of cancellation, and frequently asked questions.

Bristol West Insurance cancellation procedures vary based on policy type. Factors like cancellation timeframes, required documentation, and potential penalties or refunds are discussed. A comprehensive table is included to provide a clear comparison of cancellation procedures for different policy types.

Understanding Cancellation Policies

Yo, future Bristol West Insurance cancelers! Navigating policy cancellations can be a total drag, but knowing the ropes makes it way smoother. This section breaks down the cancellation policies, covering everything from car insurance to home insurance, so you can cancel your policy like a pro.

Cancellation Policy Overview

Bristol West Insurance has specific rules for canceling policies. These policies ensure fairness for both the customer and the company. Understanding these policies is crucial for a smooth and hassle-free cancellation process.

Cancellation Procedures by Policy Type

Different policy types have different cancellation procedures. This table Artikels the general process for canceling various policies with Bristol West Insurance.

| Policy Type | Cancellation Method | Required Documents | Cancellation Timeframe |

|---|---|---|---|

| Car Insurance | Online, phone, or mail | Policy details, driver’s license, proof of address | Typically 14 to 30 days’ notice, but check policy specifics. |

| Home Insurance | Online, phone, or mail | Policy details, proof of address, proof of ownership (if applicable) | Typically 30 to 60 days’ notice, but check policy specifics. |

| Other Policies (e.g., Travel, Pet) | Typically online or by phone | Policy details, relevant documentation as Artikeld in the policy | Refer to policy specifics. |

Requirements for a Valid Cancellation Request

A valid cancellation request needs to adhere to certain requirements. This ensures a clear understanding of the cancellation process and helps both parties avoid potential issues.

Canceling Bristol West insurance can be straightforward, but navigating the process might require a bit of research. For those seeking assistance with tech support, exploring resources like the Cincinnati Computer Cooperative in Cincinnati, OH, Cincinnati Computer Cooperative Cincinnati OH might offer valuable insights, although they likely won’t directly address insurance cancellation procedures. Consult Bristol West’s official channels or a financial advisor for accurate cancellation instructions.

- Provide complete policy details. This includes the policy number, your name, and any other relevant information.

- Clearly state your intention to cancel the policy. This is important to avoid any misunderstandings.

- Ensure all required documents are included. These documents may vary depending on the policy type.

- Adhere to the specified cancellation timeframe. This timeframe is crucial to ensure a smooth process.

Circumstances Allowing Policy Cancellation

There are specific circumstances under which a customer can cancel a policy. These circumstances can vary based on the policy type.

- If you’ve moved, canceling your home insurance policy is a standard procedure.

- Changes in personal circumstances, such as job loss or a significant life event, may warrant policy cancellation.

- If you’re unhappy with the service or coverage, reviewing your options and potentially canceling is a valid choice.

Important Considerations Before Cancellation

Yo, peeps! Before you ditch your Bristol West insurance, lemme break down the crucial things to think about. Cancelling early ain’t always the easiest move, so understanding the potential fallout is key. Knowing the dos and don’ts will help you make the right call.Cancelling your policy prematurely can have some serious consequences, so it’s crucial to weigh the pros and cons carefully.

It’s like selling your ride before you’ve paid off the loan – there are hidden costs.

Potential Consequences of Early Cancellation

Cancelling early can impact your coverage and potentially lead to financial repercussions. For example, if you cancel before your policy’s renewal date, you might lose out on any discounts or bundled benefits you’ve been enjoying. Think of it like a subscription service; cancelling early might mean losing access to perks.

Implications on Existing Claims and Outstanding Payments

If you have an ongoing claim or outstanding payments, cancelling your policy could complicate matters. It’s essential to understand how the cancellation will affect these outstanding issues. Bristol West might have specific procedures for dealing with claims and payments during a policy cancellation.

Penalties and Fees Associated with Early Cancellation

Some insurance providers charge penalties for early cancellation. These fees can vary depending on several factors, like the duration of the policy and the reason for cancellation. This is a potential cost you need to consider. Imagine paying a fee for breaking a contract; it’s similar here.

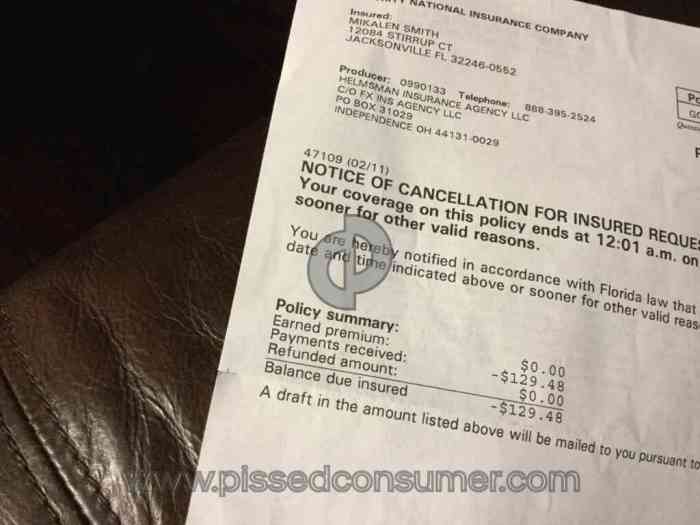

Refund Process for Canceled Policies

The refund process for canceled policies can vary. Bristol West may deduct any unpaid premiums, administrative fees, or other charges from the refund amount. Be prepared for possible deductions, and ensure you understand the specific process Artikeld by Bristol West for policy cancellations. Knowing the refund process is crucial for avoiding surprises.

Factors to Consider Before Cancelling

Before you pull the trigger on canceling your policy, carefully consider these key factors:

- Policy terms and conditions: Review the policy’s fine print. Understanding the terms is essential to avoid surprises down the line. Check if there are specific clauses related to cancellation and the associated penalties.

- Outstanding claims or payments: Settle any outstanding claims or payments before canceling. This ensures a smooth transition and avoids further complications.

- Alternative insurance options: Explore alternative insurance options if you’re looking for better deals or coverage. Don’t rush into canceling without considering other alternatives.

- Financial implications: Calculate the total cost of cancellation, including any penalties or fees. Weigh this against the cost of maintaining the policy. A financial analysis is vital.

- Your needs and requirements: Evaluate if your current insurance policy still aligns with your current needs. If not, consider alternatives.

Steps for Cancelling a Bristol West Insurance Policy

Yo, future insurance-free peeps! Cancelling your Bristol West policy can seem daunting, but it’s totally doable. This guide breaks down the process, whether you’re tryna do it online, over the phone, or through the mail. Just follow the steps, and you’ll be good to go!

To cancel your Bristol West insurance policy, review the specific procedures outlined in your policy documents. For those considering similar homeownership programs, the House Charlotte program in Charlotte, NC, house charlotte program charlotte nc , might be an alternative to explore. Consult Bristol West’s customer service for detailed cancellation instructions.

Online Cancellation

Navigating the online portal is often the quickest way to cancel. This method is super convenient, especially if you’re already familiar with your account’s online interface. Make sure you’ve got your login details ready to go.

- Log into your Bristol West account. This usually involves entering your username and password.

- Locate the policy cancellation section. This is typically found within the “My Account” or “Manage Policy” area. It might be a link or a button labeled “Cancel Policy.”

- Fill out the cancellation form. The form will likely ask for confirmation of your details, policy number, and the reason for cancellation. Be meticulous here; typos can cause delays.

- Review and submit. Double-check all the information before hitting the submit button. Once submitted, you’ll likely receive a confirmation email or notification within the portal.

Phone Cancellation

Calling Bristol West directly can be a good option if you prefer talking to a person. It’s great for those who feel more comfortable with a voice interaction.

- Get the cancellation number. Look up the cancellation number on the Bristol West website or in your policy documents. Having the number ready speeds up the process.

- Contact Bristol West customer service. Be prepared to provide your policy details and the reason for cancellation. You might need to verify your identity, so keep your policy documents handy.

- Follow the representative’s instructions. The representative will guide you through the cancellation process, and ensure your details are correctly recorded.

- Obtain confirmation. Get a confirmation number or written confirmation of the cancellation from the representative. This is a crucial step for keeping track of the cancellation.

Mail Cancellation

Cancelling via mail is a more traditional method. It involves sending a formal request to Bristol West. Keep a copy of the cancellation letter for your records.

- Prepare a formal cancellation letter. Include your policy number, full name, address, and contact information. Clearly state your intention to cancel the policy. Provide the reason for cancellation, if applicable.

- Enclose all necessary documents. You may need to attach copies of your identification and proof of address. This is crucial for verifying your identity and address.

- Send the letter via certified mail. This ensures you have proof of delivery, and a record of when your cancellation letter was received.

- Keep a copy of the certified mail receipt. This will act as your proof of cancellation request.

Cancellation Process Flowchart (Example – Online)

| Step | Action | Outcome |

|---|---|---|

| 1 | Login to Bristol West account | Access account dashboard |

| 2 | Navigate to cancellation section | Find the cancellation option |

| 3 | Fill out cancellation form | Complete the form |

| 4 | Review and submit | Request submitted |

| 5 | Receive confirmation | Policy cancelled successfully |

Handling Post-Cancellation Issues

Cancelling your Bristol West insurance policy is just the first step. You gotta be prepared for potential hiccups after you hit that “cancel” button. Knowing how to handle outstanding payments, claims, and confirmations is key to a smooth transition. This section breaks down the dos and don’ts for a seamless post-cancellation experience.Post-cancellation issues can range from simple administrative snags to more complex claim disputes.

Understanding the process for resolving these issues beforehand can save you a lot of headache. This section Artikels the crucial steps to take after you’ve canceled your policy, ensuring a hassle-free experience.

Potential Post-Cancellation Issues

Handling potential problems after cancellation is crucial. Issues can arise concerning outstanding payments, unresolved claims, or delayed confirmations. Being proactive in addressing these issues can prevent unnecessary stress.

- Outstanding Payments: Ensure all outstanding premiums are cleared before the cancellation is finalized. Failure to do so could lead to further charges or complications.

- Unresolved Claims: If you have an active claim, make sure to complete the claim process before canceling your policy. Leaving an active claim unresolved might affect your future insurance options.

- Delayed or Missing Cancellation Confirmation: A delayed or missing cancellation confirmation could cause confusion and uncertainty. Understanding the confirmation process and timeframe can help you stay on top of the situation.

Addressing Outstanding Payments, How to cancel bristol west insurance

Addressing outstanding payments post-cancellation is important. If you have any outstanding payments, it’s crucial to settle them before finalizing the cancellation process. Failure to do so can result in continued charges or negative marks on your credit report.

- Verify outstanding balance: Contact Bristol West to confirm the exact amount due before making any payment. This ensures you’re paying the correct amount and avoids overpayment.

- Choose payment method: Bristol West offers various payment options. Choose the most convenient method and ensure proper documentation of the payment to avoid any disputes.

- Maintain records: Keep copies of all payment records, including transaction IDs and confirmation numbers, as proof of payment.

Addressing Unresolved Claims

If you have an active claim, it’s vital to resolve it before canceling your policy. Leaving a claim unresolved might impact your future insurance options or create issues with the cancellation process.

- Complete the claim process: Ensure all necessary documents and information are provided to Bristol West to expedite the claim process.

- Check claim status regularly: Stay updated on the status of your claim. If there are any delays or issues, contact Bristol West for clarification.

- Settle the claim: Once the claim is resolved, verify the settlement amount and method of payment. Keep a record of this settlement.

Contacting Bristol West Insurance

Knowing how to contact Bristol West is essential for resolving post-cancellation issues. Using the right channels ensures a timely response and effective communication.

- Phone: Bristol West provides a dedicated customer service phone line for handling various inquiries, including post-cancellation issues.

- Email: Using the official email address for inquiries about your cancellation or outstanding claims helps ensure proper documentation.

- Online portal: Bristol West’s online portal might offer a platform for tracking your cancellation status and handling related inquiries.

Cancellation Confirmation Timeframe

Understanding the timeframe for cancellation confirmation is crucial. Knowing the expected timeframe can help you stay organized and anticipate potential delays. This avoids unnecessary worries about the cancellation process.

- Standard timeframe: Bristol West usually provides cancellation confirmation within a specific timeframe, typically stated in their policy documents or during the cancellation process. Always check your policy documents.

- Factors affecting timeframe: Various factors, such as the complexity of your claim or payment situation, can affect the confirmation timeframe. Be prepared for potential delays if necessary.

Obtaining a Cancellation Confirmation Document

Getting a cancellation confirmation document is important. It serves as proof of your policy cancellation.

- Requesting confirmation: Contact Bristol West to request a formal cancellation confirmation document.

- Verification methods: Ensure the confirmation document includes details such as your policy number, cancellation date, and any outstanding payments.

- Keeping records: Keep a copy of the confirmation document for your records.

Frequently Asked Questions (FAQ): How To Cancel Bristol West Insurance

Hey gengs! Cancelling insurance can feel a bit daunting, but knowing the ins and outs makes it way smoother. This section breaks down the most common questions about canceling your Bristol West policy, so you can chill and get it sorted out.This FAQ section provides clear answers to frequently asked questions regarding Bristol West insurance policy cancellations. Understanding these details will help you navigate the process smoothly and avoid any potential issues.

Policy Cancellation Timeframes

Knowing how long the cancellation process takes is crucial. Different policies have different timelines for processing cancellations. Bristol West typically has a set timeframe for processing requests, usually around 10-14 business days. However, this timeframe can vary depending on the specific circumstances of your policy. For example, if you have outstanding claims, the processing time might be longer.

It’s always a good idea to contact Bristol West directly to get an accurate estimate of the processing time for your particular situation.

Cancellation Due to Relocation

Moving? No sweat! Cancelling your policy when you relocate is a pretty standard procedure. You can absolutely cancel your policy if you’re moving. Just remember to provide Bristol West with your new address and any necessary documentation. This ensures a smooth transition and prevents any gaps in coverage.

It’s a good idea to confirm the procedure with Bristol West in advance, as this will ensure a clear and quick process.

Cancellation for Non-Renewal

If your policy is expiring, and you don’t want to renew, the process for cancellation is straightforward. Just notify Bristol West of your decision to not renew your policy within the specified timeframe. The timeframe for this will be Artikeld in your policy documents. Ensure you understand the cancellation process, so you don’t miss any deadlines.

Handling Outstanding Claims During Cancellation

Having outstanding claims during cancellation can impact the timeframe. The processing of any outstanding claims will be handled as a separate process. Contacting Bristol West to discuss any outstanding claims is essential to avoid any issues during the cancellation process. They can help you understand how the outstanding claim affects the cancellation timeline and any implications.

Payment Refunds After Cancellation

Getting a refund after canceling your policy can depend on various factors. Some policies have specific clauses regarding refunds. If you’re entitled to a refund, the process can take a few business days. Keep in mind that any refund may be subject to certain conditions and deductions, so checking the specific policy details is essential. Bristol West has specific policies about refunds, so it’s recommended to contact them directly to understand your refund options.

Contacting Bristol West for Assistance

If you’re facing any questions or need clarification regarding your cancellation, contacting Bristol West is essential. They have dedicated customer support channels to address any queries or concerns you might have. Their website usually has contact information or you can call them directly. This is the best way to ensure a quick and straightforward solution to any issues you might encounter.

| Question | Answer |

|---|---|

| How long does it take to cancel my policy? | The cancellation process typically takes 10-14 business days, but this can vary based on outstanding claims or specific policy details. Contact Bristol West directly for an accurate estimate for your situation. |

| Can I cancel my policy if I’m moving? | Yes, you can cancel your policy if you’re moving. Just provide Bristol West with your new address and any necessary documentation. Confirm the procedure with them in advance. |

| What happens if I have outstanding claims during cancellation? | Outstanding claims will be processed separately. Contact Bristol West to understand how this impacts the cancellation timeline. |

Contacting Bristol West Insurance

Yo, future insurance-cancelers! Figuring out how to reach Bristol West can be a total game-changer when you’re ready to ditch your policy. Knowing the ropes for contacting them directly will save you major time and stress. Let’s dive into the different ways to connect.

Contact Methods

Getting in touch with Bristol West Insurance is super straightforward. They offer a variety of ways to reach their customer service team, making it easy to find the method that works best for you.

- Phone: Dialing their customer service line is a quick and efficient way to get immediate help. Having a clear understanding of your policy details will streamline the conversation and ensure a smoother cancellation process.

- Email: Sending an email is a great option for those who prefer written communication. It allows for a record of your correspondence, which is super useful for tracking the cancellation process.

- Online Chat: Many insurance providers, including Bristol West, have online chat options. This can be incredibly convenient for quick questions or immediate assistance. Chat support usually provides real-time responses and can help you get things sorted out quickly.

- Mail: For those who prefer traditional methods, Bristol West has a physical address for sending letters. This is a great option if you prefer to send a formal cancellation request or have a document to send.

Contact Information

Bristol West Insurance provides various ways to connect with them, ensuring you can reach them no matter your preference. Knowing the different methods available allows you to choose the one that best suits your needs and comfort level.

| Contact Method | Details |

|---|---|

| Phone | You can reach Bristol West Insurance’s customer service department by calling their dedicated phone number. Be sure to have your policy details ready to share. |

| They have a dedicated email address for customer inquiries. Use a clear subject line that identifies your request (e.g., “Policy Cancellation Request – [Your Policy Number]”). | |

| Online Chat | Check their website for the online chat feature. Chat support is usually available during business hours. |

| Postal Mail | For official mail correspondence, you can send letters to their physical address. Make sure to include all relevant details about your policy. |

Hours of Operation

Bristol West Insurance’s customer service hours are critical to know. Planning your call or email during their operational hours ensures your message will be received and responded to promptly. Check their official website for the most up-to-date information.

Email Correspondence Process

To contact Bristol West Insurance via email, be sure to use a professional tone and include all relevant information about your policy. This includes your policy number, full name, and the reason for your cancellation request. This will help ensure your email is processed effectively.

Postal Address

The official mailing address for Bristol West Insurance is readily available on their website. Use this address when sending physical mail. Using the correct address is crucial for ensuring your letter reaches the right department and is processed correctly.

Final Review

In conclusion, canceling a Bristol West insurance policy requires careful consideration of the policy’s terms and potential consequences. This guide has presented a detailed overview of the cancellation process, encompassing crucial aspects like policy types, cancellation methods, and potential post-cancellation issues. By following the Artikeld steps and addressing any concerns through available channels, customers can navigate the cancellation process effectively.

Clarifying Questions

How long does it take to cancel my policy?

The cancellation timeframe varies depending on the policy type and the chosen cancellation method. Consult the policy documents for specific details or contact Bristol West Insurance directly for clarification.

Can I cancel my policy if I’m moving?

Yes, you can cancel your policy if you are moving. However, the policy cancellation process might be subject to additional requirements. Review your policy terms and contact Bristol West Insurance for specific instructions.

What documents are required for canceling a policy?

The necessary documents vary based on the policy type. Policy details, proof of address, and driver’s license are examples of required documents. Refer to the policy documents or contact Bristol West Insurance to obtain a complete list of required documents.

What are the potential penalties for canceling a policy early?

Potential penalties for early cancellation are contingent on the policy’s terms. Review the policy documents or contact Bristol West Insurance to determine the specific penalties applicable to your situation.